-

The Easiest 50R that I ever made!

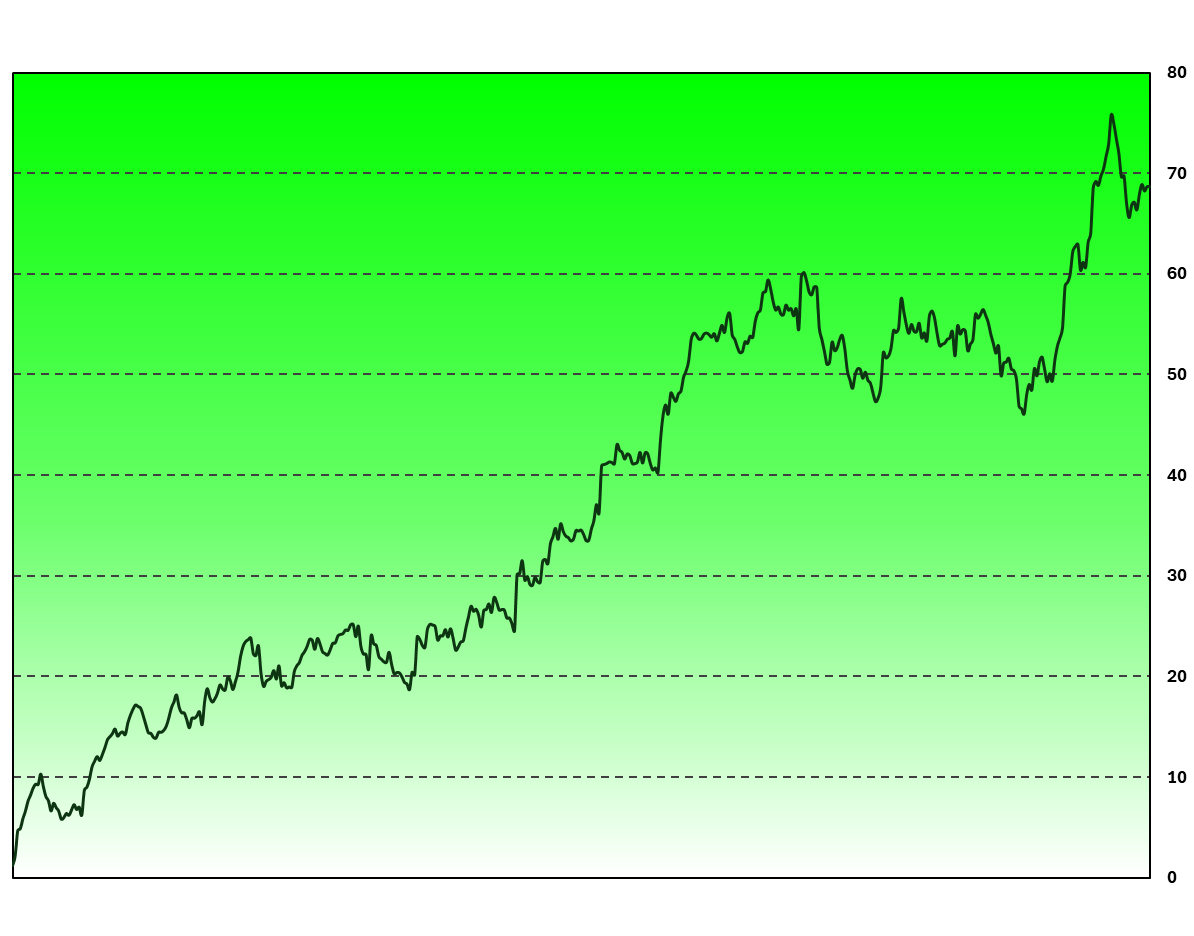

I thought I’d cracked the code. Right out of the gate, I made 50R—with almost zero screen time. I entered trades at the close using Market on Close (MOC) orders and exited at the open with Market (MKT) orders.

Fifty R with minimal effort—it felt like the world was my oyster. The two 10R+ drawdowns about three-quarters of the way through shook my confidence a bit, but the strong rally at the end was a welcome surprise.

-

Overall Summary

During the earnings season that began in January 2025—right before major market shifts—the strategy delivered 68.8R in total performance. My risk unit grew from $25 to $100 by the end of the season. Of the 443 stocks that were traded, 23% were in clean uptrends, 29% in clean downtrends, and 48% moved sideways.

Downtrending stocks were the standout performers, producing 43R in gains. There were exceptional short opportunities, with FMC (-33.5%), SWKS (-28.2%), and MEI (-24.9%) posting the largest gap-downs within already established downtrends.

-

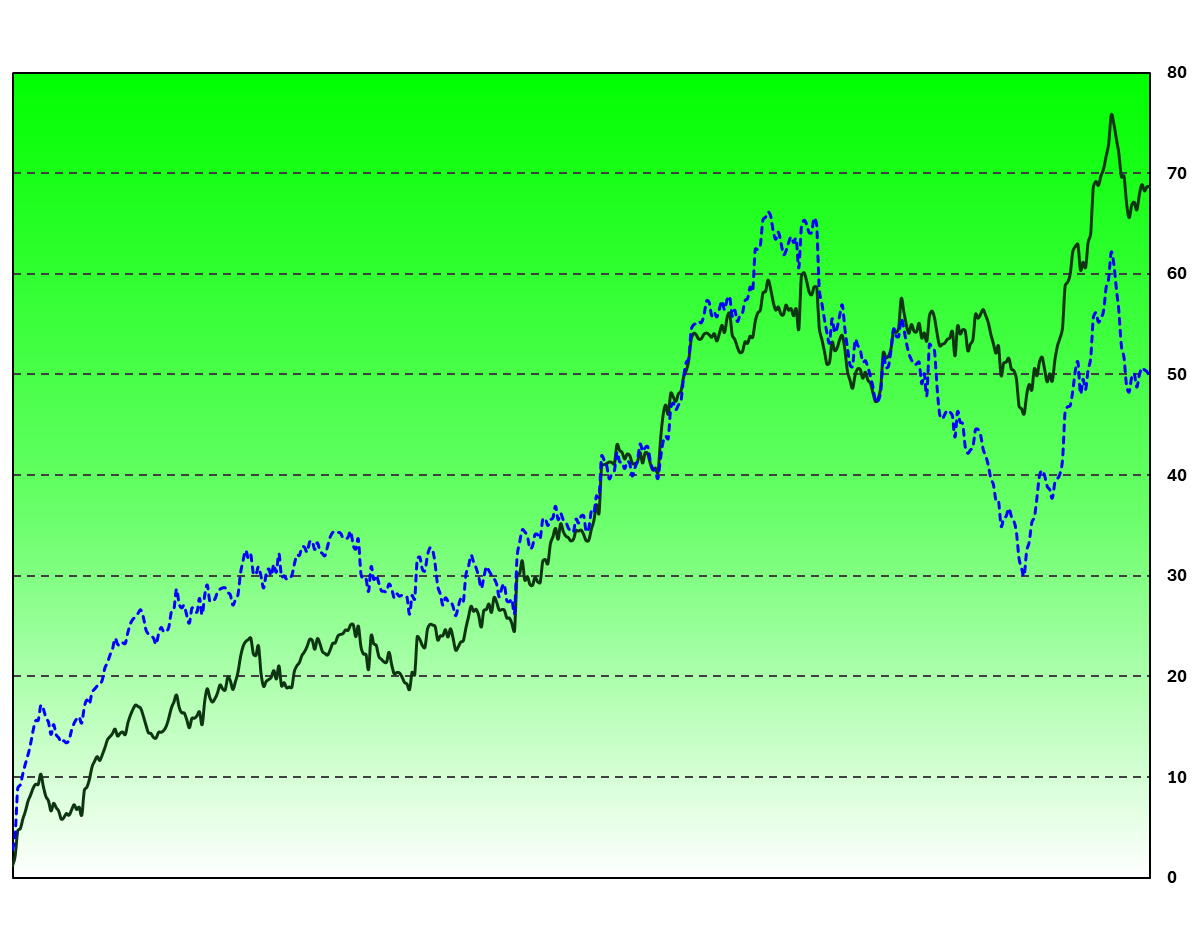

Exiting at MOC wasn't Better

I tested my trade management to see if holding positions until the next day’s close—exiting with a Market on Close (MOC) order—instead of selling at the open would improve results. As shown by the blue line on the chart above, the MOC exit looked stronger at first, but that edge quickly disappeared. Having dozens of open trades all day isn’t exactly relaxing either—you end up glued to the screen and wondering if maybe you should exit some of them. Honestly, I was relieved to see no real advantage. It’s nice to be flat at the open and done for the day.